In commercial real estate, there are several of note. What Affects Commercial Property Value?īefore diving into the specific valuation methodologies, it is important to understand what aspects of a commercial property drive its value. In both cases, real estate property values – and the methodologies used to calculate them – matter because an owner wants to do everything they possibly can to maximize their return. This is because the profit that results from the difference between the purchase price and the sales price is one of the largest components of investment returns on commercial property. When it comes time to sell the property, sellers are motivated to get as much as they possibly can for it.

As such, buyers are incentivized to pay as little as possible in a purchase. So, getting the property value right in the purchase phase is a critical first step towards making a healthy profit. The Purchaseĭuring the purchase phase of a transaction, a commercial property can be an excellent investment opportunity in all regards, but it can be difficult for a real estate investor to meet their return objectives if they pay too much to acquire it. It matters most in two places: the purchase and the sale.

#Income property evaluator driver

Very simply, the price paid for a commercial real estate property may be the single biggest driver of investment returns in a commercial real estate transaction. Why Does Commercial Property Value Matter? To learn more about our current property offerings, click here. In our own due diligence at FNRP, we utilize all approaches to valuation to ensure we pay a favorable price.

#Income property evaluator drivers

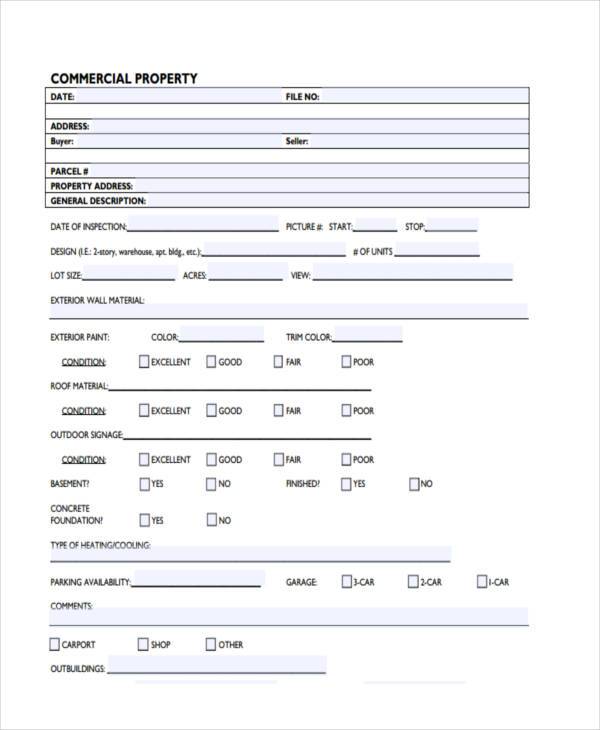

Once finished readers will have a good idea of the drivers of commercial real estate value and the approaches used to calculate it. In this article, we describe different valuation methodologies for commercial real estate. The result of these calculations can be used as a starting point in the price negotiations between buyer and seller in a commercial real estate deal. In other words, value is not totally subjective. But, there are a number of industry standard methodologies used to approximate the value of a commercial property based on a number of factors. A property’s value is only worth what a buyer is willing to pay for it. In the world of commercial real estate investment, this is also true … mostly. There is an old adage that something is only worth what someone is willing to pay for it.

0 kommentar(er)

0 kommentar(er)